Only a bank with dental-practice experience can maximize the value of a practice’s equity

Most banks struggle to determine the value of a dental practice when considering a loan. To an experienced bank the process is simple.

Lending to a homeowner is easy. You simply determine the market value of the home and calculate the size of the loan accordingly.

But a dental practice is different. There are few tangible assets. Most of the value is in the goodwill –– the hard work, sweat and tears the dentists have put into the practice to build its reputation on the market. But it’s hard to value goodwill, and even harder to use it as collateral for a loan.

Fortunately, about 85 percent of Affinity Bank’s clients are dentists, so we’ve long since figured out how to value a practice.

Three factors come into play:

- The average sale price for a healthy practice in your market area.

- The bank’s tolerance for risk at any given time.

- The profit margins of the practice and its ability to consistently generate sufficient cash flow to pay it current and future debts.

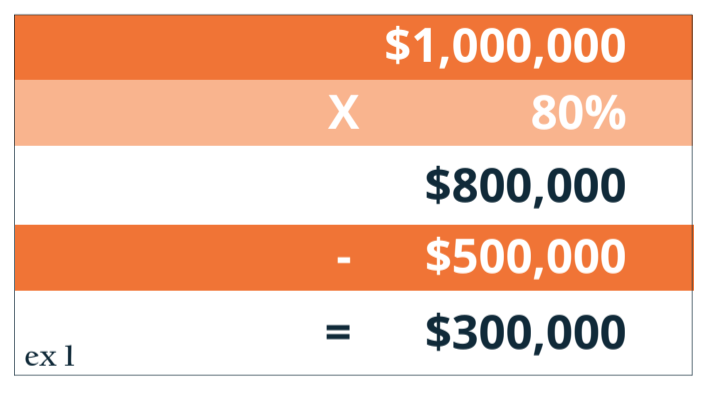

Here’s a hypothetical example:

A practice averages $1 million a year in collections over the last three years. Further, in the designated market area, the average sale price has been about 80 percent of average annual collections. Finally, let’s assume an existing debt of $500,000.

The formula for potential “lendable practice equity” is the average collections of the practice multiplied by the regional sale-price-to-collections ratio minus the debt of the practice. For this example: $1 million times 80 percent = $800,000 minus $500,000 = $300,000.

Keep in mind that the lendable practice equity is only one factor in the decision. Also considered are the practice’s profit margins and its ability to generate enough cash to cover existing and future debts.

Once the lendable equity is determined, the practice can apply it to a variety of objectives:

- The practice may want to buy real estate in anticipation of a possible expansion. Most banks require clients to put up 15-20 percent in cash for real estate purchases, but Affinity Bank has often lightened a portion of that down payment with a loan to the practice.

- Renovation of existing leased space is a common objective. We have often used practice equity to cover the costs of those projects.

- Rolling student debt into the debt of the practice can provide potential tax advantages.

- Credit lines and equipment purchases are also common reasons for loans.

We often work closely with a practice’s CPA or tax attorney to make sure an equity loan fits the specific needs of the practice. With our extensive experience in dental practice lending, we can help dentists minimize risk and achieve their financial and professional goals.