May 2021 - PPP Applications Closed

We are No Longer Accepting Applications

Affinity Bank and Newton Federal Bank has proudly served our small business community by ensuring new and established clients were able to provide compensation to employees.

Thousands of applications processed. From the early days of the pandemic in 2020 through May of 2021, we are pleased with our ability to step it up and heed the call – especially when mega-institutional banks ignored small business needs.

Be sure to contact your banker for exploring additional ways we can serve you.

READY WHEN YOU ARE – AFFINITY BANK

WE’RE BETTER TOGETHER – NEWTON FEDERAL

April 2021 - Resources for Bank Clients

SBA Officially Opening PPP - Accepting Applications

The SBA is officially opening the second draw PPP program Wednesday, January 13th. We began accepting applications from existing clients of the bank on Monday, January 11th.

We are no longer accepting ANY PPP applications from non-clients. In order to qualify as a client, you have to have opened an account on or before 12/31/2020.

If you would like to apply for a second draw loan, please send your information to ppp2021@myaffinitybank.com. We cannot emphasize the importance of only sending a single email.

FIRST STEP – SELECT APPLICATION

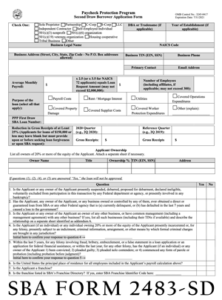

- Second Draw for Filing Under Schedule C, using Gross Income (Use this form only if the applicant files an IRS Form 1040, Schedule C, and uses Gross Income to calculate PPP loan amount.) SBA Form 2483-SD-C (3/21) >>

- Second Draw for All Other Applications SBA Form 2483-SD (3/21) >>

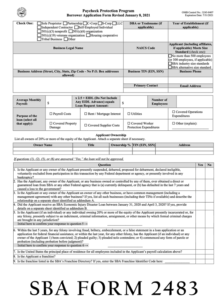

- First Draw for Filing Under Schedule C, using Gross Income (For those applying for the first time, use this form only if the applicant files an IRS Form 1040, Schedule C, and uses Gross Income to calculate PPP loan amount.) SBA Form 2483-C (3/21) >>

- First Draw for All Other Applications – SBA 2483 PPP Borrower Application webpage>>

- First Draw for Filing Under Schedule C, using Gross Income (For those applying for the first time, use this form only if the applicant files an IRS Form 1040, Schedule C, and uses Gross Income to calculate PPP loan amount.) SBA Form 2483-C (3/21) >>

- Borrower Acknowledgement Form >>

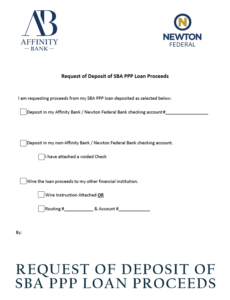

- Competed PPP Funding Document – Request of Deposit of SBA Paycheck Protection Program Loan Proceeds Form >>

- Financials validating your “average monthly payroll” figure. This will expedite your application process. You can use either 2019 financials or 2020 financials. Remember to “cap” each employee at $100,000.

- Financials proving a 25% reduction in total revenue. This may be omitted if less than $150,000, but you will have to provide this information to be eligible for any forgiveness.

If you participated in PPP during 2020 using our Bank, you are an existing client. Our process for this round of PPP loans will be very similar to what we have done in the past.

Each client will send a single email with all necessary documents attached. If you want your application processed quickly, please refrain from using external links and password protected documents as that will slow your application down.

We also ask for your patience returning calls and emails. There will be a delay as we work diligently to process applications.